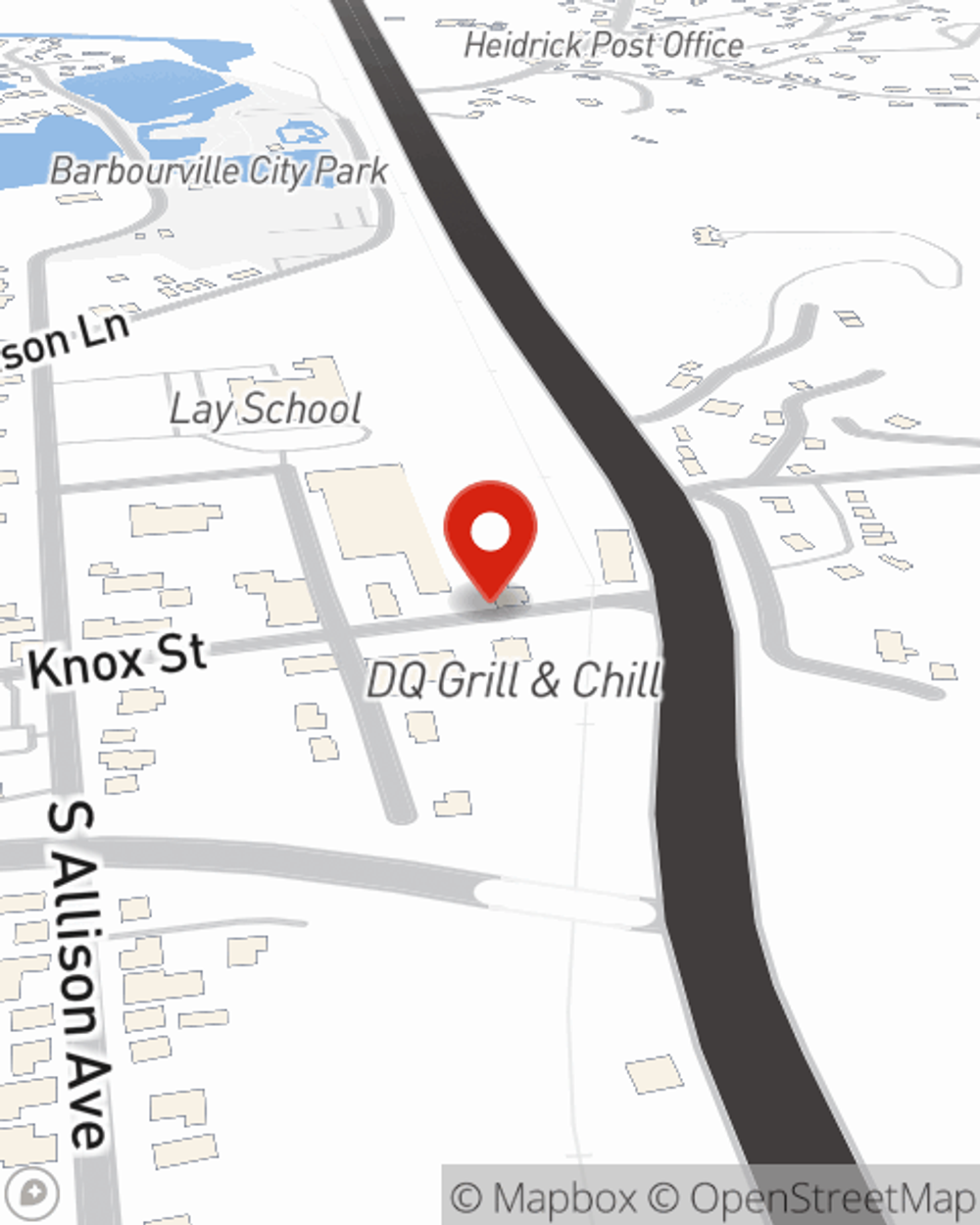

Business Insurance in and around Barbourville

Calling all small business owners of Barbourville!

Cover all the bases for your small business

- Knox County

- Clay County

- Manchester

- Harlan

- Cumberland

- Whitley

- Gray

- Evarts

- Southeast Kentucky

Cost Effective Insurance For Your Business.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, a surety or fidelity bond and worker's compensation for your employees, you can feel confident that your small business is properly protected.

Calling all small business owners of Barbourville!

Cover all the bases for your small business

Cover Your Business Assets

Your company is unique. It's where you earn a living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a shop or a facility. Your business is your life's work. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers many occupations like a podiatrist. State Farm agent Jeffrey Branum is ready to help review coverages that fit your business needs. Whether you are a florist, an acupuncturist or a piano tuner, or your business is an acting school, a clothing store or an art store. Whatever your do, your State Farm agent can help because our agents are business owners too! Jeffrey Branum understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Get right down to business by calling or emailing agent Jeffrey Branum's team to review your options.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Jeffrey Branum

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.